| Irish Forums Message Discussion :: Not just Irish banks in trouble. UK Banks bankrupt |

| Irish Forums :: The Irish Message

Forums About Ireland and the Irish Community, For the Irish home and Abroad. Forums include- Irish Music, Irish History, The Irish Diaspora, Irish Culture, Irish Sports, Astrology, Mystic, Irish Ancestry, Genealogy, Irish Travel, Irish Reunited and Craic

|

|

Not just Irish banks in trouble. UK Banks bankrupt

|

|

|

| Irish

Author |

Not just Irish banks in trouble. UK Banks bankrupt Sceala Irish Craic Forum Irish Message |

|

Brian Whelan

Sceala Philosopher

Location: Kildare

|

| Sceala Irish Craic Forum Discussion:

Not just Irish banks in trouble. UK Banks bankrupt

|

|

|

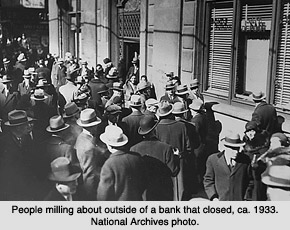

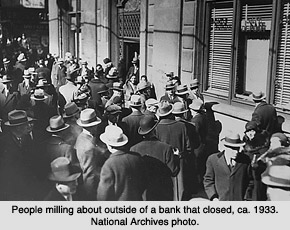

We can not blame Brian Cowen or any other Irish politician, for every problem we now face. Irish banks are not the only banks in trouble. Many of the world's banks have failed and many more are technically bankrupt.

UK Banks are in trouble again

News today that the UK banks may need another and new bail-out. A think tank says that British banks may need another state bailout next year and their borrowing requirements could hit £25 billion sterling a month.

The independent New Economics Foundation (NEF) think-tank said it had examined Bank of England data and concluded that many UK banks appeared to face a funding cliff.

Royal Bank of Scotland and Lloyds had to be part-nationalised as they ran up huge losses during the credit crisis, and others such as Barclays and HSBC have benefited from cheap credit provided by the central bank.

UK banks have a January 2012 deadline to repay £185 billion they borrowed from the Bank of England against £287 billion of illiquid assets, mostly residential mortgage backed securities, under the BoE's Special Liquidity Scheme.

They also face further pressure from new banking industry rules, due to be phased in by January 2019, which will require banks to hold more capital, and today Switzerland laid out tough new requirements for Credit Suisse and UBS.

An analyst in London said the likelihood of state aid being extended for the banks next year could not be excluded. 'There is wholesale funding which the government guarantees at the moment, and that may have to continue,' the analyst said.

Credit rating agency Standard & Poor's said in August that several UK banks were overly reliant on wholesale funding that is government guaranteed or central bank funded.

List of bankrupt or acquired banks from 2008/2009

Northern Rock UK bankrupt or acquired bank

Bear Stearns, New York City

Catholic Building Society UK bankrupt or acquired bank

Countrywide Financial, Calabasas, California

Alliance & Leicester UK bankrupt or acquired bank

Roskilde Bank DK

Fannie Mae and Freddie Mac US

Derbyshire Building Society UK bankrupt or acquired bank

Cheshire Building Society UK bankrupt or acquired bank

Merrill Lynch, US

American International Group, US

Lehman Brothers, US

HBOS UK bankrupt or acquired bank

Washington Mutual, Seattle, Washington US

Bradford & Bingley UK bankrupt or acquired bank

Fortis NL BL FR

Dexia The Belgian, French and Luxembourg governments

Wachovia, Charlotte, North Carolina US

Landsbanki Iceland

Glitnir Iceland

Kaupthing Bank Iceland

BankWest AUS

Sovereign Bank, Wyomissing, Pennsylvania US

Barnsley Building Society UK bankrupt or acquired bank

National City Bank, Cleveland, Ohio US

Commerce Bancorp, Cherry Hill, New Jersey US

Scarborough Building Society UK bankrupt or acquired bank

IndyMac Federal Bank US

Anglo Irish Bank IRL

BTA Bank Kazakhstan

Alliance Bank Kazakhstan

Bank of Antigua

Straumur Investment Bank Iceland

Dunfermline Building Society UK bankrupt or acquired bank

Caja de Ahorros Castilla La Mancha ESP

Philippine American Life and General Insurance Company

Chesham Building Society UK bankrupt or acquired bank

CajaSur ESP

Banks are continuing to fail all over the world in 2010.

|

|

|

|

|

|

|

|

|

|