| Irish Forums Message Discussion :: Obama's U.S. and Ireland. Who is more bankrupt. |

| Irish Forums :: The Irish Message

Forums About Ireland and the Irish Community, For the Irish home and Abroad. Forums include- Irish Music, Irish History, The Irish Diaspora, Irish Culture, Irish Sports, Astrology, Mystic, Irish Ancestry, Genealogy, Irish Travel, Irish Reunited and Craic

|

|

Obama's U.S. and Ireland. Who is more bankrupt.

|

|

|

| Irish

Author |

Obama's U.S. and Ireland. Who is more bankrupt. Sceala Irish Craic Forum Irish Message |

|

turkeydevine

Sceala Clann T.D.

Location: United States

|

| Sceala Irish Craic Forum Discussion:

Obama's U.S. and Ireland. Who is more bankrupt.

|

|

|

At least you guys understand you have a problem.

I sure hope you are not waiting for us to save you. Let's get real, Hussein Obama is making sure the U.S. is bankrupt, that's what Hussein Obama is shooting for.

Obama's U.S. and Ireland. The bankrupt connection.

Who is more bankrupt.

CBO current estimates that each person in the USA debt burden is approximately $430,000.

Ireland's Doleful Lesson for The U.S.

By Steve McCann

This past spring, much of the world's attention was focused on the financial dilemma in Greece. While the news managed to slightly penetrate the attention span of the average citizen of the United States, it was largely ignored. After all, it was Greece, a country that seems to revel in its laid-back psyche and history of economic and government upheavals.

Today, however, lost in the coverage of the midterm elections, the Tea Party and Christine O'Donnell's high school hijinks is the news that Ireland, a country to which nearly 40 million Americans can trace their ancestry, is on the brink of insolvency. This is not a nation with a recent history of financial and political turmoil, but one that can serve an object lesson as to where the United States is headed.

This is not a story with the same sex-appeal as analyzing what makes Obama tick or what is happening in the Tea Party movement or the chronicling of the loony acts of some on the Left, but it is one much closer to home than we care to admit, and one happening to a country with whom this nation has so many emotional ties.

In the 1990s and the early part of this decade, Ireland's growth rate had earned it the nickname of "the Celtic Tiger." But much of the boom was financed with borrowed cash. From 2003 to 2007, the Irish banking system imported funds equivalent to over 50% of the nation's Gross Domestic Product, thus triggering a runaway real estate and construction bubble.

Cheap loans, with a tacit nudge by the government, were virtually forced upon the Irish people. Mortgages amounting to 120% of the cost overpriced apartments were taken out, with the cash left over used to purchase new cars or other consumer items. New hotels, offices, and shopping centers (which were not needed) sprang up throughout much of the country. There appeared to be no end in sight as the government and banking system worked hand in hand promoting policies that created a massive financial bubble.

The world financial crisis put an end to these excesses, and the boom came to a halt practically overnight. Today the unemployment rate is nearly 14%, and defaults on mortgages have hit epidemic levels. The banks have countless loans on their books that are no longer being serviced, and the underlying collateral is virtually worthless. The Irish government has had to bail out or nationalize numerous banks, the final cost of which is yet to be determined.

Tax revenues to the government between 2008 and 2009 dropped by 19%, and the annual budget deficit as a percent of the GDP hit 15.4% versus an average of 1.1% from 2003-2008. In 2010, the deficit may well exceed 18%-20% of GDP (worse than Greece). In only two years, 2008 to 2010 (est.), the general government debt will have gone from 44% of the GDP to nearly 80% (a phenomenal 82% increase).

The Irish government has had to turn to the international market to sell bonds to finance this debt. Last week, for example, the Irish state sold 1.5 billion euros of bonds on the market; however, the interest rate was extremely high, and the default insurance premiums on these same instruments hit a record high. Total interest costs were 8% of all government revenue in 2009 (as compared to an average of 4.3% during 2003 to 2008). It is estimated that interest costs will exceed 12% of all revenue in 2010.

In an effort to continue receiving support from the European Union and to have the European Central Bank and the IMF buy their bonds, the Irish government has been forced to make severe cutbacks in expenditures, particularly wages and salaries in the public sector and reductions in some social spending. However, these savings will not be enough, and in December 2010, when the government prepares the budget for next year, the steps to be taken will have to be much more draconian if Ireland expects to receive additional loans on the international capital markets.

The world financial markets have been forced to calculate the very real possibility of what would happen if Ireland went bankrupt. There is a deep mistrust of the ability of Ireland to avoid a default (thus the high interest and premium rates). If the austerity measures are not sufficient and the markets lose all confidence, then the only option will be the euro-zone bailout fund, which will result in the tacit loss of Irish sovereignty, the further decline of property prices and wages, and a near-permanent high unemployment rate which may take decades to repair.

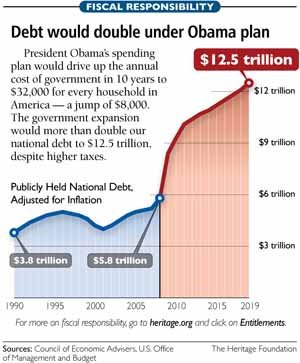

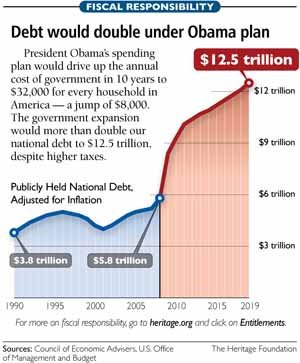

How does this sad tale compare to what is happening in the United States? First, on a comparative statistical basis:

National Debt as a Percent of GDP: Ireland in 2010: 75%; USA est. in 2012: 74%

Deficit as a Percent of GDP: Ireland in 2010: 18%; USA 2009: 10%

Interest Cost as a Percent of Govt. Revenue: Ireland 2010: 12%; USA 2010: 19%

Current Unemployment Rate (comparative basis): Ireland: 13%; USA: 10.6%*

As matters stand today, two factors are different between the two countries: first, while Ireland has begun, albeit through coercion, a major cost-cutting program, the United States is continuing its profligate ways; and second, unlike Ireland, the United States has nowhere to turn for a bailout.

The consequences of what the current administration in Washington is doing are inevitable: a head-on collision with national bankruptcy. But many still live in a dream state willing to accept the mellow-toned assurances of those in the governing class, particularly Barack Obama, that they have everything under control. It would behoove all of us, particularly the media, to look across the ocean to a country we all know so well and come face-to-face with reality.

*Calculated on the same basis as Ireland, with labor force dropouts considered unemployed.

|

|

|

|

|

|

|

|

|

|