| Irish Forums Message Discussion :: Irish bank Robbery. Largest ever Irish state bank robbery. |

| Irish Forums :: The Irish Message

Forums About Ireland and the Irish Community, For the Irish home and Abroad. Forums include- Irish Music, Irish History, The Irish Diaspora, Irish Culture, Irish Sports, Astrology, Mystic, Irish Ancestry, Genealogy, Irish Travel, Irish Reunited and Craic

|

|

Irish bank Robbery. Largest ever Irish state bank robbery.

|

|

|

| Irish

Author |

Irish bank Robbery. Largest ever Irish state bank robbery. Sceala Irish Craic Forum Irish Message |

|

KylePErin

Sceala Clann

Location: Cocoa Beach, Florida, USA

|

| Sceala Irish Craic Forum Discussion:

Irish bank Robbery. Largest ever Irish state bank robbery.

|

|

|

One of the largest bank robberies in Ireland has taken place without much notice.

No national newspaper has made a mention. RTE has not reported one of the largest bank robberies to have ever taken place in the Irish state.

I sometimes wonder why I left Ireland, get all sentimental, then I wake up.

I noticed Kerrin had predicted last year, that this sort of Irish bank Robbery would happen.

Kerrin on Mon Nov 29, 2010 9:55 am

Patrick Honohan former employee of the IMF has put a for sale sign over state..tax payer funded assets. Patrick Honohan former employee of the IMF has put a for sale sign over state..tax payer funded assets.

By default ....Collectively the Irish tax payers will be assisting foreign buyers to take over our subsidized banks at a heavy discount.

One obvious economic fact ...the Irish banks will not be sold ...unless some fund/business sees a potential profit!

This of course means that the Irish banks will be restructured ... divided up for sale ..good parts left after bad parts stripped out.

We the Irish tax payers will be absorbing paying for all the bad parts, the liabilities ....paying for all the reckless loans and bad debts. Effectively we are now subsidizing the remaining ...the good parts ...the assets divided out to be then sold on the international markets ...for someone else to profit from.

Patrick Honohan role in the bail out crisis

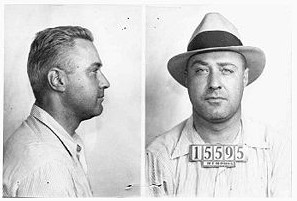

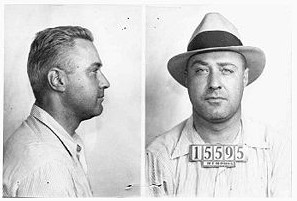

There was a time when Irish bank robbers at least had the decency to rob banks the more acceptable way, with risk to themselves as well as the public.

If only he knew the profits to be made for such low personal risk, Machine Gun Kelly would have become a vulture investor.

Very sadly in Ireland, it seems the average Irish person has been made so dumb, they don't even notice their own state banks being robbed. That was why the most recent and largest scale Irish bank robbery in the history of the Irish state went unmentioned. Even the so called journalists who were reporting all the evidence of the assets of a Irish bank being robbed in broad daylight. They just could not put two and two together.

Read between the lines.

Can you spot the Irish bank robbery.

Answer provided at the end, in case you miss the largest Irish bank robbery since the formation of the state.

Headline was

Time not right for B of I rate cut, says new investor

When does a vulture investor be classified as a robber?

In a state with principles for humanity.

Time not right for B of I rate cut, says new investor

SIMON CARSWELL and MARIE O’HALLORAN

ONE OF the new North American investors in Bank of Ireland has said that the time is not right for the bank to pass on European Central Bank interest rate reductions to mortgage customers.

New York investor Wilbur Ross, who has taken a 9 per cent stake in the bank, said the lender needed a more “normalised” funding environment to pass on ECB rate cuts.

Mr Ross, a billionaire investor, made his comments as the Minister for Finance Michael Noonan ruled out the introduction of emergency legislation to force banks to cut mortgage interest rates in line with ECB reductions.

Bank of Ireland, Ulster Bank and NIB have refused to pass on the recent quarter-point ECB rate reduction, while AIB and other Irish lenders have cut their rates.

Mr Ross told Reuters that the bank’s high funding costs made it difficult to pass on the reduction and defended the position of Bank of Ireland chief executive Richie Boucher in the face of growing pressure to pass on the rate cut.

“I can assure you that Richie Boucher is well aware of the need for responsible pricing of loans and also is aware that lower rates make it easier for borrowers to remain current in their payments,” said Mr Ross.

“High funding costs are hopefully a temporary phenomenon. In a more normalised environment, it would become easier to synchronise interest rate spreads with changes in rates charged by ECB.”

The State has a 15 per cent stake in Bank of Ireland, which is covered by the Government guarantee, and has pumped €4.2 billion into the lender.

Mr Ross was among a group of US and Canadian investors who injected €1.1 billion in the bank, taking a 35 per cent stake.

Mr Noonan said he hoped Bank of Ireland and Ulster Bank would “do what their peers have done and pass on the interest rate cut, and consequently comply with ECB and Government policy”.

Mr Noonan told the Dáil that the deputy governor of the Central Bank in charge of financial regulation, Matthew Elderfield, was not seeking additional powers.

Mr Elderfield “prefers to use the powers he has, together with his powers of persuasion which are considerable, to affect the interest rate”, said Mr Noonan.

The Minister told Sinn Féin finance spokesman Pearse Doherty that much of Ulster Bank’s funding came through sterling and the Bank of England as it was a subsidiary of Royal Bank of Scotland. He said that it did, however, access ECB funds. The State now only owned 15 per cent of Bank of Ireland, he said.

Explaining why he was not going to introduce emergency legislation, the Minister said that “binding controls tend to reduce availability of credit and channel it to the most creditworthy customers, starving smaller and less secure customers from credit”.

Mr Elderfield had indicated that this “could have a chilling effect on the entry of sound competitors into the market”, Mr Noonan said.

The Minister said if banks were absolved of their responsibility to price risk accurately, binding interest rate controls would impede the development of practices that “can ensure a healthy and free-standing banking system no longer dependent on the Government for bailouts”.

Mr Doherty called on the Minister to introduce legislation to cut rates. Mr Boucher had “rubbed the noses of the Government in it when he was invited to a meeting with the Taoiseach”, he said.

He asked if the Minister was “going to do nothing about it”.

Mr Noonan replied: “Sinn Féin historically has a different approach to getting people to do what it wants them to do than our party would have.”

The Government “will see how the situation develops over the coming weeks”.

http://www.irishtimes.com/newspaper/finance/2011/1116/1224307639350.html

The Answer to the question - Did you spot the Irish bank Robbery. One of, if not the largest ever Irish state bank robbery.

How did you all miss this?

- The State has a 15 per cent stake in Bank of Ireland, which is covered by the Government guarantee, and has pumped €4.2 billion into the lender. - The State has a 15 per cent stake in Bank of Ireland, which is covered by the Government guarantee, and has pumped €4.2 billion into the lender.

- Mr Ross was among a group of US and Canadian investors who injected €1.1 billion in the bank, taking a 35 per cent stake.

I guess you will have to be satisfied with the criminal implication of the word - taking.

As being as near it ever gets as anyone seeing this for what it is - a daylight robbery.

Kerrin in his same post warning of this event, also predicted the nerve of these vulture robbers investors.

Selling the AIB and BOI will not be a good move in any way. It is not the Irish banks who are the most impatient with repossessing family homes. Most repossessions in Ireland are forced through by foreign financial institutions. Selling the AIB and BOI will not be a good move in any way. It is not the Irish banks who are the most impatient with repossessing family homes. Most repossessions in Ireland are forced through by foreign financial institutions.

Finally a Irish bank robber who has some shame, no such thing as a honest robber, or a honest criminal. But some shame is refreshing.

Bank heist man pleads guilty 'to prevent wasting public money'

Monday, December 05, 2011

A man guilty of attempting an elaborate bank heist represented himself in court today because he “doesn’t want to waste any more public money”.

John O’Connell (aged 48 ) of Roseberry Lane, Lucan and another man spent five nights tunnelling into an Offaly bank from a vacant building next door.

He was sentenced to five years by Judge Patrick McCartan after he changed his plea to guilty mid-trial.

When he was arrested O’Connell was wanted for a “copycat” offence six months previously where €250,000 was taken from an AIB. He has never been charged with the AIB offence.

O’Connell, who represented himself, pleaded not guilty to burglary, criminal damage and conspiracy to rob at the old Post Office, JKL Street, Edenderry on April 26, 2009.

Shortly after the trial began today however, he changed his plea to guilty on the burglary and criminal damage offences.

The prosecution accepted the pleas and O’Connell asked to be sentenced immediately. When Judge McCartan asked him if he would like professional representation he declined saying: “I don’t want to waste any more public money, your honour.”

O’Connell’s co-accused, John Foy (aged 48 ) of Cashel Avenue, Crumlin was sentenced two weeks ago for his role. He was sentenced to one year, in addition to a 12-year term he is already serving for a separate armed bank robbery

Before dismissing the jurors, Judge McCartan thanked them for their time and told them there was “a stack of evidence” proving the accused’s guilt. When the judge asked O’Connell why it took him so long to change his plea, he replied that he was “terrified” of going to jail.

“But you’ve been there before”, Judge McCartan said, noting O’Connell’s 16 previous convictions including one for indecent assault and a 10-year sentence for false imprisonment and aggravated burglary.

The judge called it “a very skilful and well thought out operation” and commended the owner of the vacant post office for alerting gardaí when he noticed signs of the tunnelling.

The men were caught in the act after gardaí observed them enter the building every night for five nights. They were arrested when the Emergency Response Unit moved in and incapacitated them using “a distraction device”.

A vacuum cleaner with a receipt, signed by O’Connell in its storage compartment, was also found in the building. The raiders had used it to clean up the dust from the tunnelling every night.

O’Connell pleaded with the judge to suspend part of the sentence, saying he has three young children and doesn’t “have the stomach for this sort of life anymore”.

He claimed his only role was to remove the brickwork in the bank wall and that he wasn’t going to be part of any armed raid. Judge McCartan rejected this and said he had given all the leniency he could to O’Connell.

Sergeant Kevin Quinn told prosecuting counsel, Mr Damien Colgan BL, that on April 20, the postmaster of the vacant post office in Edenderry noticed signs of interference with an interior wall that backs onto the Bank of Ireland.

He alerted the gardaí who set up a surveillance operation on the building. Every night over the next week gardaí watched Foy and O’Connell climb through a window into the post office where they removed bricks and mortar from the bank wall.

To get into the post office they had cut the metal bars on the window and replaced them with removable bars which could be replaced every night.

When they had finished every night they would hide the debris and their tools under the floorboards and replace the plasterboard on the wall to conceal the hole.

They also cut a lock on the gate and put it back together with a piece of wire to avoid arousing suspicion during the day. Inside they had hung a large black piece of fabric across the windows to block the view from the street.

By the time gardaí moved in at 2am on April 26, the men had cut a three foot by three foot hole though the wall and into the bank. The ERU entered and incapacitated the men using a stun grenade-like device.

In interview O’Connell claimed he was there because he had come up from Dublin to buy €10 worth of “hash” in the vacant post office.

O’Connell, a brick-layer and cement supplier, claimed in court that he was only there to do the brickwork however Sgt Quinn rejected this.

The sergeant said he believed O’Connell and Foy intended to rob the bank in daylight hours once they completed the hole.

irishexaminer.com/breakingnews/ireland/bank-heist-man-pleads-guilty-to-prevent-wasting-public-money-531081.html#ixzz1g8HgwXdY

|

|

|

|

|

|

|

|

|

|