| Irish Forums Message Discussion :: Aged and broke UK is extreme fiscal risk |

| Irish Forums :: The Irish Message

Forums About Ireland and the Irish Community, For the Irish home and Abroad. Forums include- Irish Music, Irish History, The Irish Diaspora, Irish Culture, Irish Sports, Astrology, Mystic, Irish Ancestry, Genealogy, Irish Travel, Irish Reunited and Craic

|

|

Aged and broke UK is extreme fiscal risk

|

|

|

| Irish

Author |

Aged and broke UK is extreme fiscal risk Sceala Irish Craic Forum Irish Message |

Blackie

Sceala Philosopher

Location: Dublin Ireland

CELTIC FC

|

| Sceala Irish Craic Forum Discussion:

Aged and broke UK is extreme fiscal risk

|

|

|

Ireland has one advantage in having one the youngest aged populations in Europe.

The whole of Europe is at risk of collapse.

‘Ageing’ Europe has least sustainable finances – France, Germany, Italy, Sweden and UK most exposed to fiscal risk

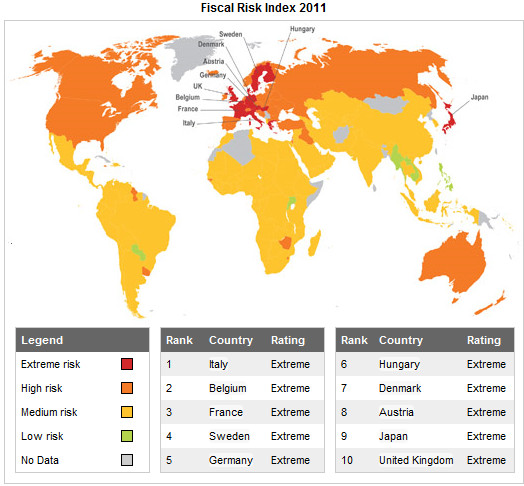

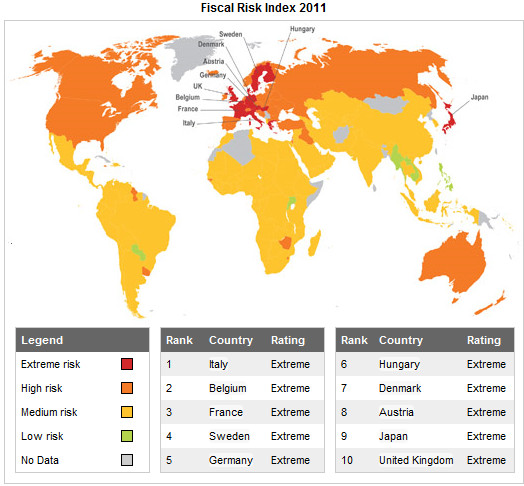

Maplecroft's Fiscal Risk Atlas 2011

According to a new ranking of 163 countries, Europe’s big economies, including France, Germany, Italy, Sweden and the United Kingdom, are the most exposed to fiscal risk due to their ageing populations, substantial levels of debt and high public spending on health and pensions.

The Fiscal Risk Index, developed by risk analysis and mapping firm, Maplecroft, identifies countries that will come under increasing economic pressure in future years due to low birth rates, high life expectancy and state commitments to look after ageing populations.

So that is what they mean by British bulldog spirit, lives to eat and sleep, and has a phobia for work.

Will the British state kill him off when no is looking, or shake the slacker awake to go work for a living.

The index is calculated using eight indicators: child and old-age dependency ratios between 2010 and 2050, labour rates of the over-65s, GDP, debt, and public spending on pensions, health and education.

The queen of England is one of the youngest women left in UK, look how young she appears in comparison to the group of British dole students.

Europe is home to 11 out of the twelve countries rated ‘extreme risk.’ These include: Italy (1), Belgium (2), France (3), Sweden (4), Germany (5), Hungary (6), Denmark (7), Austria (8 ), United Kingdom (10), Finland (11) and Greece (12). Japan (9) is the only other country in the highest risk category.

The ‘extreme risk’ countries are characterised by increasingly ageing populations and high public spending on social security. Maplecroft states that high life expectancy will place more pressure on public expenditure because pensions will need to be paid to more people for longer and an older populace will place larger burdens on health systems. At the same time, the working-age population in these countries is shrinking, meaning contributions to public pensions will likely decrease.

In the UK, there are currently 25 old people for every 100 of working age (25%). This is forecast to rise to 38% by 2050. Whilst high, the UK projection pales against other ‘extreme risk’ countries, including: France 47%, Germany 59%, Italy 62% and Japan at the very top with 74%.

In a report from June 2009, the IMF suggested that the fiscal implications of ageing populations could dwarf the impact of the recent financial crisis in terms of national accounts. It estimates that the net present value of the financial crisis is about 11% of what ageing related spending will cost.

These old troopers show the way as they head off to a 12 hour shift at B&Q.

Even the dyed-in-the-wool Unionists doubt the future purely on economics.

Some of you had written of this economic reality here, warning that Ireland was healthy by comparison.

Ireland has at least opened up her cooked books. London is trying to bluff the markets out.

The Unionists will be begging for a united Ireland before long. As soon as enough agree to be Irish. They will become the most insular Irish of all, the first and loudest to demand that we close our open borders to the UK and the EU.

Unionist Belfast telegraph.

Britain rated 'extreme' fiscal risk

The UK's ageing population and huge debt have propelled it into the top 10 of countries threatened by unsustainable public finances

The UK's ageing population and huge debt have propelled it into the top 10 of countries threatened by unsustainable public finances, new research has found.

Britain is now one of 12 nations rated "extreme risk" in the Fiscal Risk Index compiled by global analysts Maplecroft.

The UK was ranked 10th in the list of 163 countries - up from 27th last year under a slightly different method of calculating positions - because of its high public spending on health and pensions, massive borrowing and shrinking working population.

The Fiscal Risk Index identifies nations that will come under increasing economic pressure in the future because of low birth rates, high life expectancy and state commitments to look after older people.

Italy topped the international league table, followed by Belgium, France, Sweden, Germany, Hungary, Denmark and Austria.

Japan came ninth, the only non-European country rated "extreme risk", with Finland 11th and Greece 12th.

Maplecroft highlighted the UK's soaring Government debt, up from 43% of GDP in 2006 to 77% in 2010, and relatively low number of over-65s in the workforce - only 7.71% compared to an average of 28% across all the countries surveyed.

It is forecast that by 2050 there will be 38 old people for every 100 people of working age in Britain, up from 25 now.

Professor Alyson Warhurst, chief executive of Maplecroft, said: "Governments in high risk countries may need to rely on business to help them absorb the costs.

"At the very least, governments will need the private sector to recruit and retain older workers and provide for more generous pension arrangements."

|

|

|

|

|

|

|

|

|

|