| Irish Forums Message Discussion :: Ireland must call the bluff of the EU Bully. |

| Irish Forums :: The Irish Message

Forums About Ireland and the Irish Community, For the Irish home and Abroad. Forums include- Irish Music, Irish History, The Irish Diaspora, Irish Culture, Irish Sports, Astrology, Mystic, Irish Ancestry, Genealogy, Irish Travel, Irish Reunited and Craic

|

|

Ireland must call the bluff of the EU Bully.

|

|

|

| Irish

Author |

Ireland must call the bluff of the EU Bully. Sceala Irish Craic Forum Irish Message |

|

bamboozileer

Sceala Philosopher

Location: Dublin

|

| Sceala Irish Craic Forum Discussion:

Ireland must call the bluff of the EU Bully.

|

|

|

The Irish politicians are acting like cowards and telling us more lies. We do have a choice. The Irish David can make Goliath the EU Bully Speculator fall.

We do have a choice. We can say no, we just can not pay and we will not pretend we can pay. That course of action is a economic fact. We can and should go further than economic fact, we should stand up and be counted. We must tell the EU that even if we had the money, we will not make the Irish public pay for the actions of white collar criminals. Mostly EU white collar criminals. Speculators and vultures working on behalf of the big German and British banks are the two main evils behind this. These foreign speculators recklessly loaned, they recklessly invested. No one put a gun to these vultures heads, their gamble on Ireland lost, tough. Why should the Irish tax payer cover their losses. Our government must say we will not make the Irish people underwrite, pay for the greed of foreign speculators.

We have to do it, it is the right choice, the only sane choice.

The Irish people did not borrow and waste billions. A small few super wealthy, super criminals did. These white collar criminals were given the money to destroy Ireland, they were funded by reckless foreign speculators.

Ireland has no moral obligation to save any white collar criminal or reckless foreign speculator.

Even the German Chancellor thinks so. Yesterday Angela Merkel gave a big hint to the stupid and cowardly Irish politicians. She has effectively told Ireland what to do. Angela Merkel has told the bond holders that they must expect to pay for their reckless lending.

Ireland does have power, we have the futures of these EU finance bullies in our own hands. If Ireland says no, Spain will follow, Portugal will follow, Greece will follow, We can bring down the whole house of cards.

All we need is a Irish leader. Unfortunately the Government and opposition leaders are not up to this task, not even second rate.

Fine Fail and Fine Gael, there is no difference. Fine Gael are even worse, nothing more than EU cheerleaders, there is nothing they will not do or say to protect their EU masters.

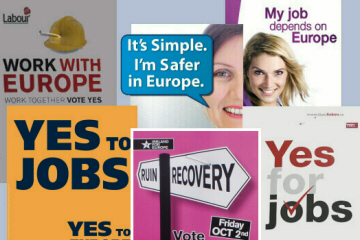

Remember these recent lies. Vote yes and save jobs.

They lied then, they are lying now.

We do have a choice.

The EU is bad for Ireland, we have nothing to be scared of.

The EU defenders do not want you to know the full story, they silence dissent, discourage questions, by presenting all opposition as insular and economic fools. The truth about Ireland and the EU is different to the myth.

The EU owe the Irish not the other way around. The commonly held myth that Ireland was a net recipient of EU funds, was spread by a small minority who did benefit, still do.

The people who defend Europe as a sacred cow, as that great institution, are usually salaried in one form by the EU. Such as that intolerably blustering woman on Frontline yesterday. The big farmers do not want to lose their grants. The EU suits do not want to lose their appointments or contracts.

What we are all suffering for? What are we agreeing to cut-back to pay-back?

Most of the billions of debts, that we are told that we all now owe, are sourced from intricate foreign speculation. Reckless foreign targeted speculation. The foreign speculators are partly responsible for Ireland's debts.

The general Irish public has not gained and are not responsible. The average European has not gained and is not responsible.

Cowen and Kenny are ordering us to pay for white collar criminals. They are effectively encouraging us to participate in the after-effects of serious white collar crime.

Ireland must call the bluff of the EU Bully.

Olli Rehn

By David McWilliams

In the back of The Tavern on Castle Street in Carlow last Saturday night the lads, under the watchful eye of proprietor Sean Furey, were downing large bottles of MacArdles.

Apart from a recent local incident involving the slaps given out to a young fella from Republic Of Ireland Og, top of the lads' worry list was the IMF and what they might do to you.

The conclusion, well into the night, was succinct -- "d'IMF will be the new 'Tans".

When lads in The Tavern in Carlow are discussing global economics, you know that the world has changed. In fact, their conclusion, painting the IMF as an occupying force, may well prove more in tune with the populace than the over-the-top welcome given to Olli Rehn by the Irish political elite -- many of whom were directly party to the destruction of the country.

In fact, the elite's al fresco sycophancy towards Rehn was a lesson in unrivalled post-colonial forelock tugging and it reveals what path the elite is likely to take in the next couple of months. That path can best be summed up by "what do we have to do for you to love us".

The fact is that Rehn will not save Ireland. On the contrary, he will use the Irish people to save the German banks.

Let's cut to the chase to see what is really going on here. Ireland's banks owe German banks alone €127bn. Looked at from another perspective, the German banks are in the hole to Irish banks and developers to the tune of close to 90pc of Irish GNP. By rubberstamping the Irish elite's bank bailout, the European Commission has saved the reckless German banks -- who don't deserve to be saved -- and punished the ordinary Irish citizen, who doesn't -- in the main -- deserve to be punished.

Rehn knows that the credibility of the euro rests in the Commission preventing a bank default or sovereign default in Ireland; but the choice facing the country now if we do nothing, is either we default eventually or, worse, we experience a slow run on the banks as the middle classes take their money out of the banking system because they simply do not trust the authorities any more.

Only by negotiating a restructuring of private debt can we avoid this eventuality. But it can be done.

The 'bank crisis' that lead to the guarantee being introduced is still rumbling on. Financial crises tend to come in waves. This first wave was a bank-funding crisis sparked when the German financiers panicked and refused to lend any more to the Irish banks. This turned into a debt crisis caused by developer loans going south. Now we have the third wave, the coming domestic mortgage crisis.

Let's be clear, this is all one big crisis. As each domino falls, the desperation of our situation becomes more obvious. But once the first domino (the bank funding crisis) had fallen, there was no stopping the process. The guarantee was supposed to make this process easier. The endgame is always an unpleasant deal with creditors where they lose. We could have used the guarantee to do this, but we chose not to. Our elite chose to pay every cent to delinquent lenders.

The first wave of the crisis, the bank funding crisis, used up all of the Government's reputation and credibility. The second wave, the large borrowers going bust, used up all of the Government's money. The third part, the residential mortgage crisis, is going to use up what's left. But the Government has no reputation left -- they can't offer another guarantee because it will not be credible. We all know they are broke, so they can't offer a bailout.

So, what does that leave? There are, believe it or not, several options still open, even at this late stage. We can decide that the mortgage holders who are in trouble are being rightly "punished" for their sins. Last week, this column tried to make it clear why this 'do nothing for the little people' policy will lead us all into the mire.

By doing nothing, we will condemn our whole society to years of zero growth, depression (the psychological kind, as well as the economic kind) and mass emigration. The generation that the Irish State would be giving up on, reacts by giving up on Ireland.

All the while as the Government's bankruptcy is laid bare, the middle classes with savings will panic and get their cash out of the country.

If we want to avoid a bank run we have to give some form of debt amnesty. It might be that the banks would have to write down the value of outstanding mortgages before they are defaulted on, rather than after. It could come through changes in the mortgage contracts so the mortgage becomes tied to the property rather than to the borrower. It could even come through changes in our bankruptcy laws so people who are in dire straits can draw a line under their past and have some chance of starting afresh.

Currently, none of the alternatives are being discussed. Yet it is clear that people are struggling with their debts and as time goes on, more will fall into the trap. The Government's excuse for inaction is that writing down the value of mortgages will leave the banks in more trouble, and by extension, the Government.

This excuse might hold water, except for one thing. The write-downs are going to happen anyway. Whether the Government is willing to admit it or not, there will be mortgage defaults in Ireland. Ignoring the problem will not make it go away. Dealing with it is the only solution.

But won't moving more debt on to the national balance sheet just make Ireland's situation worse? Yes and no. True, government debt will grow bigger when it has to bail out the banks again to cover the mortgage losses, but it is important to remember that this debt already exists in the economy. We will just be moving it around a bit through some creative accountancy (and anyone who read the government press release last week on the promissory notes will know this Government is not afraid of a little creative accountancy).

Of course, this will put more pressure on our bonds, as government debt would rise again, but not if we did a deal with our creditors to restructure all our debt at the same time. The deal with mortgage holders would be paid for by a similar but more severe deal with the creditors. The fact that the main creditor is now the ECB, actually makes renegotiation easier. What bit of "lender of last resort" does Mr Trichet not understand? In fact, what bit of "bank run" does he not understand?

There is a deal to be done which puts the Irish people first. It is not the deal that Rehn came here to do, but it is the only deal that will give the average Irish person hope. And if politics isn't about hope in the future, what is it about?

David McWilliams hosts Ireland's first economic festival in Kilkenny this weekend. kilkenomics.com

- David McWilliams

independent.ie/opinion/columnists/david-mcwilliams/david-mcwilliams-government-must-cut-deal-that-gives-the-people-hope-2413679.html

|

|

|

|

|

|

|

|

|

|