| Irish Forums Message Discussion :: Britain is Bankrupt but Gordon is still giving world advice. |

| Irish Forums :: The Irish Message

Forums About Ireland and the Irish Community, For the Irish home and Abroad. Forums include- Irish Music, Irish History, The Irish Diaspora, Irish Culture, Irish Sports, Astrology, Mystic, Irish Ancestry, Genealogy, Irish Travel, Irish Reunited and Craic

|

|

Britain is Bankrupt but Gordon is still giving world advice.

|

|

|

| Irish

Author |

Britain is Bankrupt but Gordon is still giving world advice. Sceala Irish Craic Forum Irish Message |

doogansdouble

Sceala Clann Counsellor

Location: Kent

|

| Sceala Irish Craic Forum Discussion:

Britain is Bankrupt but Gordon is still giving world advice.

|

|

|

There is way too much doom and gloom on here. Hahahehe --You all thought Ireland had economic problems. This will have all you Irish in Ireland -- feeling not quite so sorry for yourselves. It could be much worse --you could be English living in England.

Gordon Brown-- has destroyed England --Economists call it a disaster zone, living on debt it can never pay back. English Botanist David Bellamy says that if things do not get better --or if things get worse, at least Ireland can feed itself. England can't, it has to import 8 times more food to what it can produce. How is it going to pay the shopping. If England was a horse --it would have been shot between the eyes to put it out of it's misery. I hope no one was listening to GB's advice last week -- it would be like someone reasonably fit and healthy taking advice from a blind and deaf junky. Everyone in England thinks that Brown is a liar, he makes up lies about how many are really unemployed -- makes the figures look better. If you have any money in English banks or building societies-- get it all out and as fast as you can. Gordon Clown will tell you the bank was robbed and all your money has gone-- the day after.

Will Britain go bankrupt?

By Associate Editor David Stevenson Mar 13, 2009

David Stevenson

Britain: on the brink of bankruptcy

And we thought we were bearish.

A research report caused a bit of a frisson in the UK press yesterday. Apparently, British house prices could fall by as much as a further 55%. Oh, and there's a real risk that the country could go bust on top as well.

This isn't a set of forecasts from some fringe pressure group. It's a report from Numis Securities, a leading firm of analysts.

But all's not yet lost. There's still a solution, says Numis. Trouble is, it's probably too painful to have any chance of happening...

House prices could fall another 55%

As our own Dominic Frisby pointed out earlier this week, the housing bust doesn't look anywhere near over (UK house prices will plummet: look at this scary chart). That almost goes without saying. But Numis Securities reckons that house prices could fall by as much as another 55%.

How do they work that out? Well, despite the 20% or so fall in house prices from the peak, the UK house price to earnings ratio is still around 4.8. That's still way out of line with the long-run trend, of between 3.5 and 4 times. That means house prices sill have to fall another 17-39% before they reach their "fair value".

A fall of that degree would be incredibly nasty - and quite likely to happen, too. After all, yesterday's figures on mortgage approvals (i.e. loans granted to people to buy houses), were down 50% year-on-year to a record low in January, pointing to more declines in store. Yet that's not the full story.

When a bubble pops, it doesn't stop at fair value. Just as prices rocket above the norm on the way up, so they plunge way below the average on the way down. And if they over-correct to the same extent as in the 1990s (which remember, was a far less drastic recession) then prices "could fall 40-55% from current levels".

That's pretty scary, though not way out of line with what our own regular columnist, James Ferguson is expecting (see James's latest take on the UK and US housing markets: Worse to come for property markets on both sides of the Atlantic).

Could Britain go bankrupt?

But even more worrying than the state of the British housing market, is the overall state of the nation's finances. Personal debt in the UK, at nearly £1.5trillion, has overtaken annual GDP – in other words, we owe more than we produce in a single year. On top of this, company borrowings add nearly another £2 trillion to the debt pile.

But the real 'bete noire' is what the government is racking up. Numis has totted up the numbers and comes to a terrifying conclusion: underlying public debt next year will reach a staggering 282% of annual GDP.

The firm's estimate of unfunded public sector pension liabilities - that's money that the government will have to pay out in pensions but which it doesn't actually have right now - comes to almost £3trn. Add it all together, and Britain's total debt mountain will stand at over 500% of GDP by 2010.

To put this figure in context, it's far bigger than at any point in our history, including wartime. And this is our fiscal position as we go into possibly the biggest recession in living memory. It's like owing more than five times your gross income - just before you lose your job.

So what does this mean? Well, for the government, it means having to sell lots more gilts to raise funds. But that will get much tougher as the debt mountain continues to grow, which means the pound will keep falling as international faith in Britain's creditworthiness steadily drops. In turn, that will push long-term interest rates ever higher to cajole foreign investors to part with their cash. Conventional gilt prices will tumble.

This could turn into a vicious downward spiral. Eventually the UK will be unable to fund itself - and will just go bankrupt. Yes, we could print oodles more money to 'pay' the government's bills. But that road just leads to hyper-inflation, like pre-revolutionary France in 1789, the 1923 Weimar Republic - and the tragedy that is Zimbabwe today.

This problem should easily be solved - but that won't happen

So is there any hope for Britain at all? Well, in fact, "the problem looks surprisingly easy to resolve", says Numis.

'Discretionary' - i.e. not absolutely essential - spending makes up almost 45% of total household outflows. So all we have to do is cut this back to the levels of the 1992 recession - stop borrowing more money and save the stuff instead - and hey presto! - problem solved.

Of course, there's a big catch. It would take more than 10 years of this sort of medicine being administered to consumers to result in a cure. And too many people have got too used to the 'must-have-it-now' mentality to have the patience to wait until they've saved up enough to buy what they want.

Further, Gordon Brown and his colleagues - and their successors, too - would have to keep their hands in their pockets for years, and not keep splashing out even more money they haven't got on a whole procession of bailouts.

Will that happen? Fat chance. The temptation for a government trying to get re-elected to keep borrowing and spending far too much will prove much too great. What's more, there's another twist. As Fraser Nelson points out in The Spectator, our Gordon seems to have sussed out how to "tweak banking regulations to buy his crappy debt, and thereby divert the nation's savings into the Treasury's coffers".

Having been sellers of gilts for 10 years, British banks, "gripped by a mysterious sense of patriotism" have bought a net £30bn-worth in the last three months – the most since data started in 1997. While there's still some cash left in the banks' vaults, expect the government to grab what it can.

It all means that sterling assets – from houses to conventional gilts to stocks exposed mainly to the domestic economy (Are shares now yesterday's story?) – will keep crumbling.

We'll be talking about how to diversify your exposure away from sterling assets in coming issues of MoneyWeek. But as we mentioned yesterday, a good start is to buy some gold – you can find out more about it here.

http://www.moneyweek.com/news-and-charts/economics/will-britain-go-bankrupt-14669.aspx

Gordon Brown brings Britain to the edge of bankruptcy

Iain Martin says the Prime Minister hasn't 'saved the world' and now faces disgrace in the history books

By Iain Martin

When will the Gordon Brown nightmare end?

They don't know what they're doing, do they? With every step taken by the Government as it tries frantically to prop up the British banking system, this central truth becomes ever more obvious.

Yesterday marked a new low for all involved, even by the standards of this crisis. Britons woke to news of the enormity of the fresh horrors in store. Despite all the sophistry and outdated boom-era terminology from experts, I think a far greater number of people than is imagined grasp at root what is happening here.

The country stands on the precipice. We are at risk of utter humiliation, of London becoming a Reykjavik on Thames and Britain going under. Thanks to the arrogance, hubristic strutting and serial incompetence of the Government and a group of bankers, the possibility of national bankruptcy is not unrealistic.

The political impact will be seismic; anger will rage. The haunted looks on the faces of those in supporting roles, such as the Chancellor, suggest they have worked out that a tragedy is unfolding here. Gordon Brown is engaged no longer in a standard battle for re-election; instead he is fighting to avoid going down in history disgraced completely.

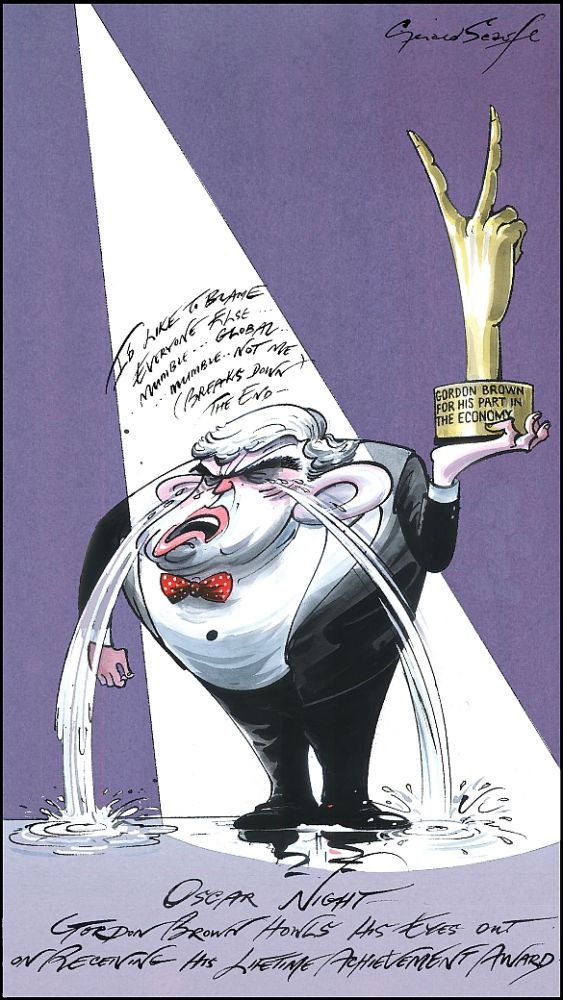

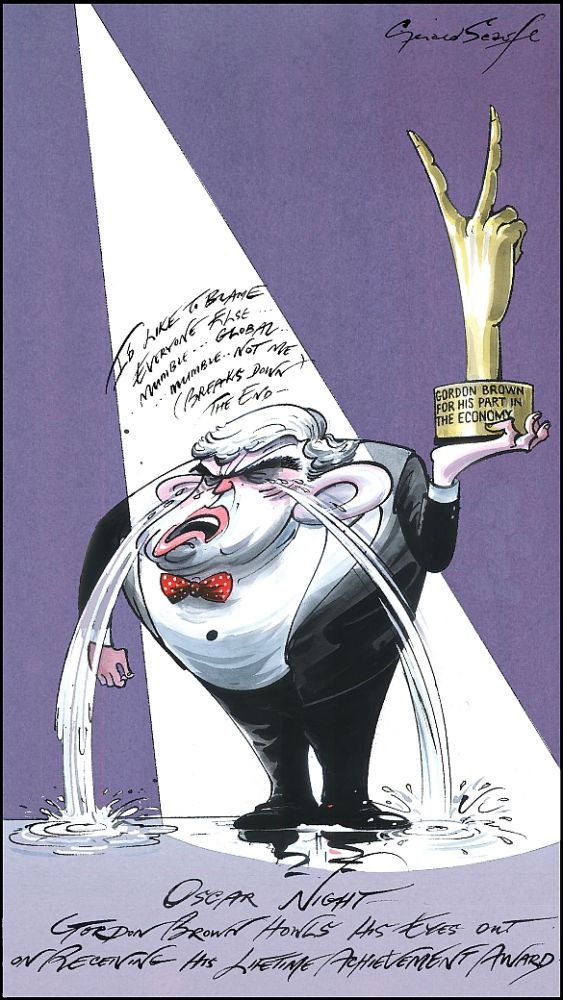

This catastrophe happened on his watch, no matter how much he now opportunistically beats up on bankers. He turned on the fountain of cheap money and encouraged the country to swim in it. House prices rose, debt went through the roof and the illusion won elections. Throughout, Brown boasted of the beauty of his regulatory structure, when those in charge of it were failing to ask the most basic questions of financial institutions. The same bankers Brown now claims to be angry with, he once wooed, travelling to the City to give speeches praising their "financial innovation".

Does the Prime Minister realise the likely implications when the country joins the dots? He has never been wild on shouldering blame, so I doubt it. But Brown is a historian. He should know that when a nation has put all its chips on red and the ball lands on black, the person who made the call is responsible. Neville Chamberlain discovered this in May 1940 with the German invasion of France.

We're some way from a similar event. But do not underestimate the gravity of the emergency and potential for disgrace.

The Government's bail-out of the banks in October with £37 billion of taxpayers' money was supposed to have "saved the world", according to the PM, but now it is clear that it has not even saved the banks. Our money kept the show on the road for only three months.

As the Liberal Democrats' Treasury spokesman Vince Cable asks: where has the £37 billion gone? The answer, as Cable knows, is that it has disappeared down the plug hole.

It is finally dawning on the Government that the liabilities of the British banks grew to be so vast in the boom years that they now eclipse the entire economy. Unfortunately, the Treasury is pledged to honour those

liabilities because it has guaranteed not to let a British bank go down. RBS has liabilities of £1.8 trillion, three times annual UK government spending, against assets of £1.9 trillion. But after the events of the past year, I wager most taxpayers will believe the true picture is worse.

Meanwhile, the assets are falling in value. This matters, because post-nationalisation these liabilities are now yours and

mine.

And they come piled on top of the rocketing national debt, charitably put at £630 billion, or 43 per cent of GDP. The true figure is much higher because the Government has used off-balance sheet accounting to hide commitments such as PFI projects.

Add to that record consumer indebtedness and Britain becomes extremely vulnerable. The markets have worked this out ahead of the politicians, as usual, and are wondering what to do next. If they decide our nation is a basket case, they will make it so.

The PM and the Chancellor , both looking a year older every day, tell us that for their next trick they will buy more bank shares, create a giant insurance scheme for bad debt, pledge to honour liabilities without limit, cross their fingers and hope it all works. The phrase "bottomless pit" springs to mind for a reason: that is what they have designed.

In this gloom, the Prime Minister has but one slender hope: that somehow, by force of personality, the new President Obama engineers a rapid American recovery restoring global confidence, energising the markets and making us all forget this bad dream.

Obama is talented but he is not a magician. Instead, Gordon Brown's nightmare, in which we are all trapped, is going to get much worse.

http://www.telegraph.co.uk/comment/columnists/iainmartin/4295219/Gordon-Brown-brings-Britain-to-the-edge-of-bankruptcy.html

|

|

|

|

|

|

|

|

|

Irish Community Site MapIrish Message Site Map

Irish Forums Message Discussion :: Britain is Bankrupt but Gordon is still giving world advice. � Sceala.com Irish Forums (Ireland) :: Designed In Ireland By Sceala The Irish

Message :: Irish Web Ireland :: Britain is Bankrupt but Gordon is still giving world advice. From Sceala The Irish Message :: Irish

Forums

|